Structuring of Chart of Accounts

The structuring of Chart of Accounts depends on following factors: -

1. Nature & Size of Business

2. Type of ERP/ Accounting Software

3. Type of MIS Requirements

In an account tree, the broad categories are Income, Expenses, Assets & Liabilities. There are two type of accounts: -

1. Ledger accounts – All the accounts which are impersonal in nature are categorised as Ledger Accounts like all kind of income, expense, asset & liability accounts

2. Control accounts- All the accounts which are personalised in nature are categorised as Control Accounts, these are further tagged to some ledger. Like Name wise suppliers account, customer account, employees accounts etc.

1. Nature & Size of Business

Broadly business operates in four different natures: -

a. Service Business: –

A business whose product is intangible in nature like professional service, advice or technical support. Example of this type of business are legal firms, accounting firms, beauty clinics, banks, hospitals, schools etc.

In case of Service Business,

· Income category for direct incomes & indirect incomes had to define very carefully, because income would be specific to each service type for different type of service businesses.

· Expenses are more of indirect in nature, but the few expenses which had direct relationship with income had to categorically identified and grouped as direct expenses. As in case of Hospitals, salary of full time Doctors would be indirect expenses but sharing fees of consultant doctors would be direct expenses.

· Fixed assets would be different for each business type so broad asset group and asset type need to define carefully like for Schools there may be digital boards, furniture, sports equipment. For Hospital it may be X-ray Machines, Other Testing equipment, Beds, Medical help equipment etc.

· Liabilities in terms of loans would be less and much own funds or unsecured loans would be involved. Like in Schools, lot of trustees are involved. So accordingly control account can be created person wise for each individual or institution within the unsecured loan grouping.

· Taxation structure, tax class & ledgers is again need to have a check as the output services are provided in many buckets so each may have to look separately for their taxability structure like in beauty clinics some of the services fall under beauty services and some fall under health & fitness services.

b. Merchandising Business: –

The type of business, where the physical products are purchased in bulk and are retailed or sold to retailers, but there is no reprocessing of products are the Merchandising Business. Example of these kind of businesses are Apparels Traders, Grocers, electronic shop and all the resellers.

In case of Merchandising Business: -

· Main Income is generally only sale of products, which can be further categorised according to customer, location may be through ledgers or through cost centres. Product wise sales can be controlled through POS (Point of sale software) or through an integrated ERP.

· Cost of goods sold includes purchases, direct expenses like freight, loading & unloading etc. which can be categorised according to location, type of suppliers, broad category of item or different business type, may be through ledgers or through cost centres. Net effect of change in inventory can be linked through POS or ERP (Inventory module).

· Fixed Assets are generally very less, and same set of support assets are used in almost all the merchandising businesses, for ex. Front store assets which may consist of Air Conditioners, Interior leasehold improvements, Furniture & Fittings, Furnishings etc. Back Office Assets & Warehouse Assets are also had similarity in more or less all the merchandising business.

· Expenses are more of Indirect Expenses and had a similarity across sector like Rent Expenses, Electricity, Security Expenses, Administrative Expenses, Business & Promotion expenses, Finance & Interest Expenses, Salary Expenses, Repair & Maintenance etc. So, the broad groups & tree of ledger need to define accordingly.

· These kinds of businesses generally have lot of bank & institution loans & working capital finances, factoring, LCs etc. so accordingly need to define the chart of account to differentiate the current & non-current liabilities properly.

c. Manufacturing Business: -

In a setup, where some inputs are purchased after a manufacturing or assembling process with the help of various services, and the resultant output is sold to customer are called the Manufacturing Business.

In case of manufacturing business: -

· The main stream of revenue is sale of products manufactured, may be one or multiple products. Control of product wise sales can be through inventory module, that I will cover in a separate writeup.

· Cost of goods sold would consist of raw material purchases, direct costs, production cost, change in inventory etc. so the account tree had to design in proper way to capture the above ledgers under right heads.

· We need to be conscious while tagging the costs as these types of business had huge production cost or direct costs, like in salary factory wages would be part of direct cost & back office salaries would be indirect, warehouse expenses for specific to a factory would be direct, but common warehouses expenses would be indirect.

· Fixed Assets would be high and also apart from corporate office assets, huge plant & machinery would be involved which need to be carefully checked for depreciation applicability with company law & income tax act so as to define its proper group & class.

· Liabilities are generally huge from multiple stakeholders, also involves various kind of financing facilities like export credit, LC, OD, Term Loans, Capital Financing, Factoring, Vehicle loans, unsecured loans etc. So, the account tree needs to design to capture secured, unsecured, short term, long term properly. Also, Treasury module can be used to track the due dates & party wise financing through LC, BG, Factoring etc.

d. Hybrid Business: -

Some of the business sells both the goods and services are called the Hybrid Business, Like Restaurant Services, Health & Beauty Treatments etc.

For these businesses, depending on the dominance of their saleable product as goods or services, they had to design the chart of accounts as per above applicable rules.

2. Type of ERP/Accounting Software

Generally, In India businesses use the following as their accounting software: -

1. Tally ERP –

Tally ERP is an accounting software need to operate with accountants, currently it had been integrated with inventory, payroll, TDS & GST modules. For small scale businesses upto turnover of about 100-200 crore, it can work. Its simple to operate & cost effective. In Tally chart of account is straight forward, it operates with ledger accounts and cost centres. Control Accounts are not workable in Tally. Also, Ledgers are classified under group or sub groups. But account code is not facilitated in Tally. For Inventory proper item names with tax class need to define in inventory module.

Most of businesses who operate on tally, had a separate POS software to capture their item wise goods receipts, billing to customer & inventory records. And they had integrated their POS with Tally to captures daily sales, so the proper ledgers need to assign to POS.

2. Quick Book / Sage/ Zoho-

These are the cheap & small versions of ERP, these are meant to used even by non-accountants like procurement departments and sales departments can account for purchase & sales respectively. In the small business upto 50-100 crore, these kinds of accounting software are used as an alternative to Tally. But flow of accounting chart & facilities are more or less same as Tally.

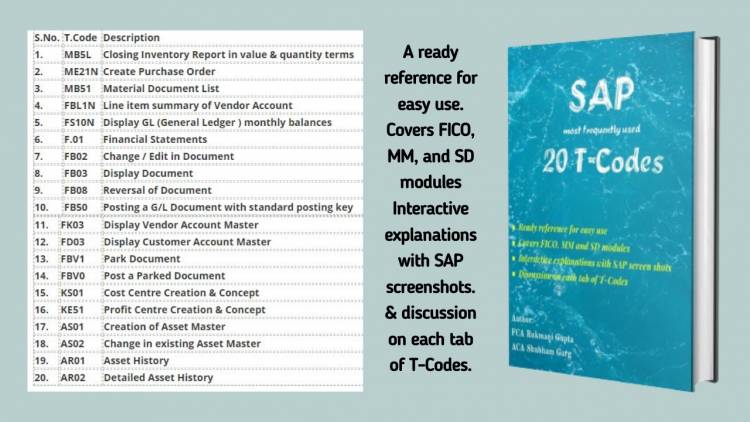

3. SAP/ ERP

Due to two factors, In the businesses below turnover of 100-200 cr., SAP is not workable, because: -

- Purchasing SAP / ERP software need huge budget.

- Regular Maintenance cost & software support & customisation services are not affordable by small business.

- Proper SAP/ ERP trained accountants are costly & difficult to find.

But for large Organizations like 1000 cr & above it is a necessity.

SAP/ ERP is an integrated system to capture all the processes like goods ordering, procurement, storage, sales, Payroll, Taxation, Fixed Assets management, vendor management, customer management, financing means etc.

Your entire organization is documented in this system, so here defining Chart of Account is the first control over your system.

It offers a very attractive way of designing the chart of accounts as below:-

a. Entire tree of accounts is properly coded in serial nos. & ranges. Before actually creating the same in system, we should create the complete tree in excel, should refine the grouping & sub groupings as per our business model, MIS requirements etc.

b. Personal accounts like creditors, customers & employees are defined as control accounts. So, the master of individuals is created separately which can be tagged to any ledger while posting a transaction. While creating masters of individual also we should capture the maximum information available like their complete contact details, tax credentials etc. This can be once a time taking activity but will help you forever.

c. Special GL indicators are again a good feature in ERP, which helps in various ways like post the payments and receipts as advance or retention or against invoice.

d. For inventory, item code again is a separate tree to be prepared consciously, we need to design category, grouping and item list as per business model. SAP/ ERP facilitates to create a coding for each category and items, which can help us to create the bar coding and naming the storage systems cabinets.

e. For Fixed Assets, SAP/ ERP facilitates a very interactive module independent of ledgers, there are broad Asset Group, which further can be classified in various sub groups to ultimate asset item code. Also, while creating the masters of asset item, it facilitates to capture all the information of asset description, qty, to assign a specific number, deprecation class etc.

f. For Payroll, again all the information relating to individual employees are captured employee wise in payroll module. A separate employee code is created for each employee. And for each employee code, full information like their personal information, salary breakups etc. are captured. So, the relevant ledgers of salary need to be properly classified to avoid redundant information.

3. Type of MIS requirements: -

Accurate and timely MIS is a key factor behind success of any business. And both the factor accuracy and timeliness can be met only if we are able to fetch right information easily and timely from our system. Chart of accounts plays a major role in the accuracy of information. I have seen in many organizations that one dedicated person or department is there to prepare bit of information compiling from various ledger because same kind of ledgers are scattered in many groups. Also, this process unnecessarily delays the MIS timelines. And decisions can not be postponed always waiting for right information thereby may result in vague and wrong decisions.

Also if information in not rightly available in a systematic tree, not everyone is comfortable in getting the information straight from system, thereby an independent MIS department survives, which actually is not the optimum use of such a heavy cost based ERP/ SAP.

But the finance leaders and the Entrepreneurs need to recognise the importance of structured chart of accounts and need to flow it from top to bottom, thereby making business actually system driven.

Download APP

Download APP

Rukmani Gupta

Rukmani Gupta