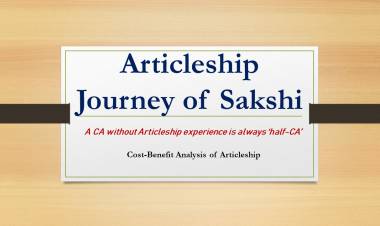

Articleship in Big4 -Pros & Cons by Siddharth Jain

I am Siddharth Jain, a simple boy from a town called Tohana in Haryana, I was an academic topper since the beginning, I was an IPCC district topper, In Oct.2015 I started my journey of Articleship, I joined Luthra & Luthra LLP, but then I got an option to join Deloitte. Though Luthra & Luthra is also one of the dream firms for students to get articleship, but I always wish to go one of big4 and did not want to lose the opportunity. Also, ICAI gives us the option to transfer from Articleship only in 1st year, so took the decision to move from Luthra & Luthra to Deloitte.

So, in Feb.2016, I switched my Articleship to Deloitte and since then I did 2 years of Articleship at Deloitte Haskins and Sells LLP Gurgaon. And remaining with a mediocre CA firm, so I got a all-round experience of big4 & mediocre firm.

Benefits of Articleship in a Big4 CA Firm

- Exposure to large Corporates

During my Articleship in Deloitte, I got an opportunity with deal with the large corporate clients like Oracle India, Amazon, Ericson India, Maruti Suzuki, Daikin, Sony etc. Which gave me a big platform to learn the following: -

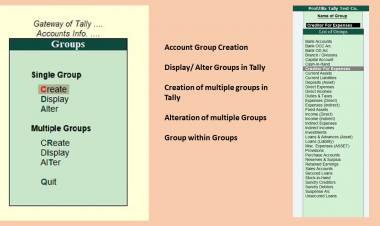

- What are the Accounting systems of large corporates?

- How their business works?

- How their internal control system works?

- What type of software are used for material management, accounting, compliances?

- How email & networking works in large corporates?

- How information system works?

- How System & data security are ensured?

- How Banking & cashflow are managed with large transactions?

- How Authority & delegation system works?

- How to deal with Team?

- How to manage business verticals

This is like, somebody gave you the entry into a treasure, its upto to us how much we can learn & expose ourselves with the knowledge gems out of that treasure.

- Exposure with the key technical areas

During my Articleship with Deloitte, I was in Global business tax team which includes direct taxation and international taxation. There were many assignments related to scrutiny and research related to income tax. I went to income tax department many times. Some were related to TDS, some related to section 263, 264 and section 154. Many a times I went for income tax hearing as well with my seniors in civic centre building in Delhi.

Following are list of few technical areas I covered during my Articleship at Deloitte: -

- India Mauritius Treaty

- Repatriation of taxes

- Lob Clause

- 27A

- Article 11, 14, 15 of tax treaties

- Analysis of high court and supreme court judgements

- Form 36

- Appeals to ITAT

- CIT(A)

- Research related to Income Tax circulars

- Minimum Alternate Taxation

- Appeal effect

- Income tax Submissions

- Paper work for ITAT

- 151CPC

- TDS matters

So the advantage is that we get opportunity to deal with specific issues in depth which otherwise we might not face throughout our career also.

Some of may friends who dealt with mergers & acquisitions, transfer pricing got specific experience related to that area is so depth & details that they become ready to tackle the technical matters of specific issues of large values.

By this exposure of specific technical areas, we become the cream choice of large corporates or big4 firms for their expert teams in that specific area, and no doubt we can get much more monetary benefits than a general tax consultant.

- Personal & Professional development

In big4 firms, we get an opportunity to interact with team, have coverage of seniors, we have a disciplined system, particular dress code, manners to be followed, public dealing, formal client interaction, attending business meetings, preparing business presentations, presenting reports & reviews.

This knowingly or unknowingly slowly injects discipline & improves our personality tracts, which differentiates us from crowd.

Disadvantages of Articleship in a Big4 CA Firm

- Missing Exposure to all round practising work

The students doing Articleship in mid-level or small level firms, get exposure to all round practising work like various tax registrations, company formation, ITR filing, GST registrations, Trademark Registrations etc. Which are the key jobs to be a practising CA career.

- Imbalance in Study vs. Office time

During articleship in Big4, generally the office working hours are more than a small-firm also the leaves available are the bare minimum.

As a student has to pursue coaching class along with Articleship, so it becomes a tight schedule to go to coaching class & attend office effectively.

- Outstation Visits

In case of Big4, generally corporate’s head offices are located at remote locations, so the Article trainees have little choice in going to far locations & outstations, which creates problem I other schedule like study & coaching classes etc.

Name: Siddharth Jain,

Location: Tohana, Haryana

Academic Background: B. Com

Firm Name: LUTHRA & LUTHRA LLP, DELHI– (Oct 15 to Dec 15)

DELOITTE HASKINS AND SELLS LLP GURUGRAM, HARYANA – (Feb.16 to Dec. 18)

Articleship Tenure: from Oct. 2015 to Dec. 2018

Experience:

General: Departmental Liasioning, TDS related work, Work related to section 263, 264, 154 of Income Tax Act., Income Tax case hearing, work on India Mauritius Treaty, Repatriation of Taxes, Article 11, 14, 15 of tax treaties, CIT(A), MAT

- Specific:

- Indirect Tax:

- Direct Tax: Scrutiny & Search related work. International Taxation Assignments.

- Finance:

- Accounts:

- Audit:

- Companies Act:

- Software used:

- Something Special:

- IT Olympiad Gold Medallist

- English Olympiad Gold Medallist

- AIR 6 - Commerce Talent Search Examination

- AIR 313 - Commerce Talent Search Examination

Main Clients handled:

- Oracle India

- Reach Hong Kong Ltd.

- Amazon

- Ericson India

- Posco South Asia

- Maruti Suzuki

- Daikin, Sony

List of Academic Achievements

- IPCC District Topper

- IT Olympiad Gold Medallist

- English Olympiad Gold Medallist

- AIR 6 - Commerce Talent Search Examination

- Bcom First Division

- AIR 313 - Commerce Talent Search Examination

- Certificate course from Sarv Saksharta Computer Education

- Merit in National Knowledge Olympiad

- First Position in Jain Vishav Bharti

- 1st position in International Informatics Olympiad

- Distinction in CPT

- School Topper in 12th boards

- Certificate of Merit from CA Ashish Kalra Sir

- Certificate of Merit from CA Mayank Jain Sir

- Participated in various exams of Jain Vidhya

- Topper in Problem Solving Assessment

- Participated in Unified Cyber Olympiad

- Done Residential Programme from ICAI, Jaipur

- Attended CA Confluence 2019 at SRCC

Download APP

Download APP