In case of death of assessee - taxability and ITR filing procedure

In case of death of Assessee: Taxability and ITR filing

A. Filing of Income tax return of deceased is mandatory or not?

As per Income Tax Act, If any person dies during the year and his income is above the minimum taxable income then it is necessary to file the income tax return of that deceased person even after his death.

B. Who will pay tax and who will file the income tax return?

First of all we have to check that the person who died has created any will or not? If he has created a will then the situation is called Intestate and if there is no any will is created by the person who died then this situation is called as Testate.

In case of Intestate situation: Legal heirs of deceased person are liable for the Income Tax compliances.

In case of Testate situation: Legal representatives of deceased person are liable for Income Tax compliances.

Now again we have to understand the taxability of deceased person in two parts:

1. Income earned before the date of death

2. Income earned after the date of death

1. Income earned before the date of death

Legal heirs (Intestate situation) or Legal representative (testate situation) of deceased person are liable for payment of taxes, interest, demand etc. which were due from the deceased person before the date of death. They have to file ITR of deceased person as from 1st April till the date of death. And all the proceedings / assessments shall remain continued against legal heirs / representatives from the same stage at which it stood on the date of death of deceased person. And similarly carry forward and set off of losses of deceased person shall be allowed.

2. Income earned after the date of death

In case of Testate situation – Income after date of death shall be taxable in the hands of legal representatives.

In case of Intestate situation –Income from the date of death till the date of distribution shall be taxable in the hands of Executors. If there are more than one executor then they shall be table as AOP (association of person).

And the residential status of executor shall be same as was of deceased person in the year of death.

C. Computation of income of deceased person

All income earned by deceased person from 1st April to the date of death would be considered as the income of the deceased. And legal heirs or legal representatives depending upon the situation – Intestate or Testate, shall be responsible for paying the tax and filing of return on his behalf.

And income earned on the assets of deceased after his death is taxable in the hands of that person who has inherited assets from deceased person.

We can understand the same with an example:

Mr. X was earning a rent of Rs. 1,00,000/- per month and he died 31st December and after his death being his assests were inherited by his legal heir Mr. Y (being Intestate situation):

Income in the hands of Mr. X = 9*100000 = 9,00,000/-

Income in the hands of legal heir Mr. Y = 3*100000 = 3,00,000/-

So in the above case legal heir Mr. Y shall be liable to pay tax on Rs. 9,00,000/- income on behalf of the deceased Mr. X and shall be liable to pay tax on Rs. 3,00,000/- as his own income.

However, amount of tax, interest, and demand payable by legal heirs on behalf of the deceased shall not be more than the assets of inherited by him. Mean to say that legal heir is not liable to pay the dues of deceased from his pocket.

D. Documents required to be uploaded for registration as legal heir at Income Tax site:

Following documents are required to be uploaded to register as legal heir:

- Copy of death certificate

- Copy of pan card of deceased

- Copy of pan card of legal heir

- Legal hear certificate, for which any one of the below is accepted:

- The legal heir certificate issued by court of law

- The legal heir certificate issued by local revenue authorities

- The certificate of surviving family members issued by local revenue authorities (generally issued in regional language, so the legal heir needs to translate it inot Hindi/English and get notarised)

- The registered will

- The family pension certificate issued by the State / Central Government

- Letter issued by Banking or Financial Institution on their head with official seal

In case there are more than 1 legal heirs then either any one of them should appoint as legal heir for filing the income tax return of deceased person. In case they all want to be registered as legal heir – they can jointly file the income tax return in the capacity of AOP or BOI.

E. Process to register as legal heir:

Step 1

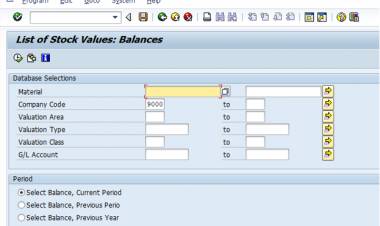

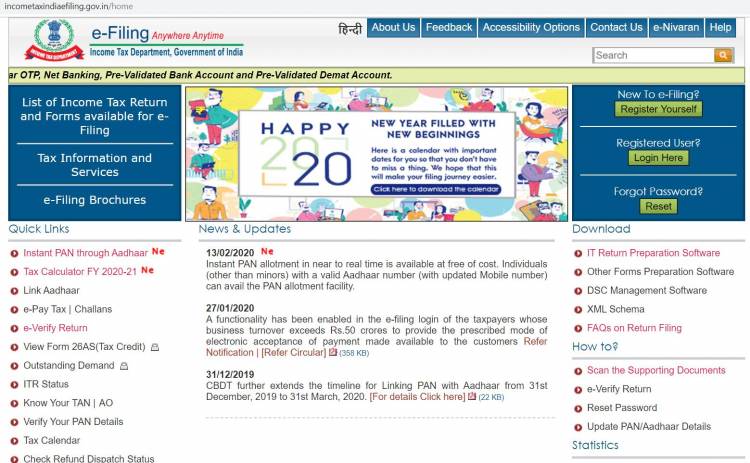

Open income tax site www.incometaxindiaefiling.gov.in

Step 2

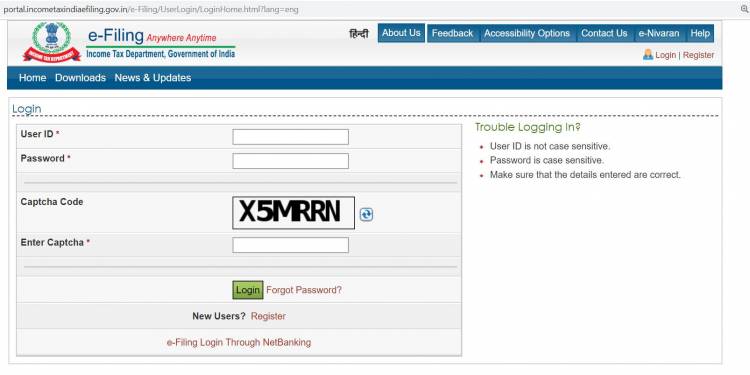

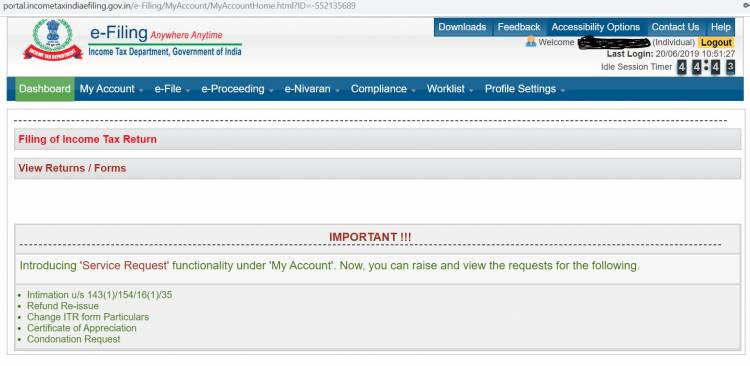

Do login with login Id and password of legal heir (if not already registered then first do register):

After login… below window shall open

Step 3

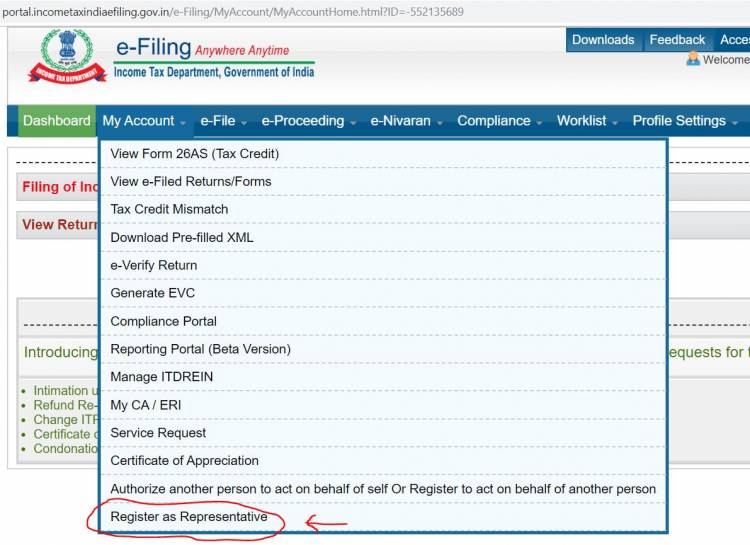

Now click on Register as representative as shown in below window

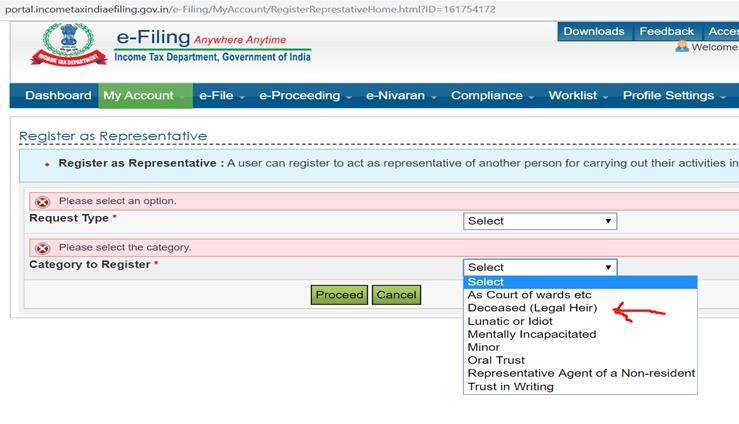

After that below window shall open, choose new request in request type and click on Deceased (Legal Heir) Tab….. as shown below

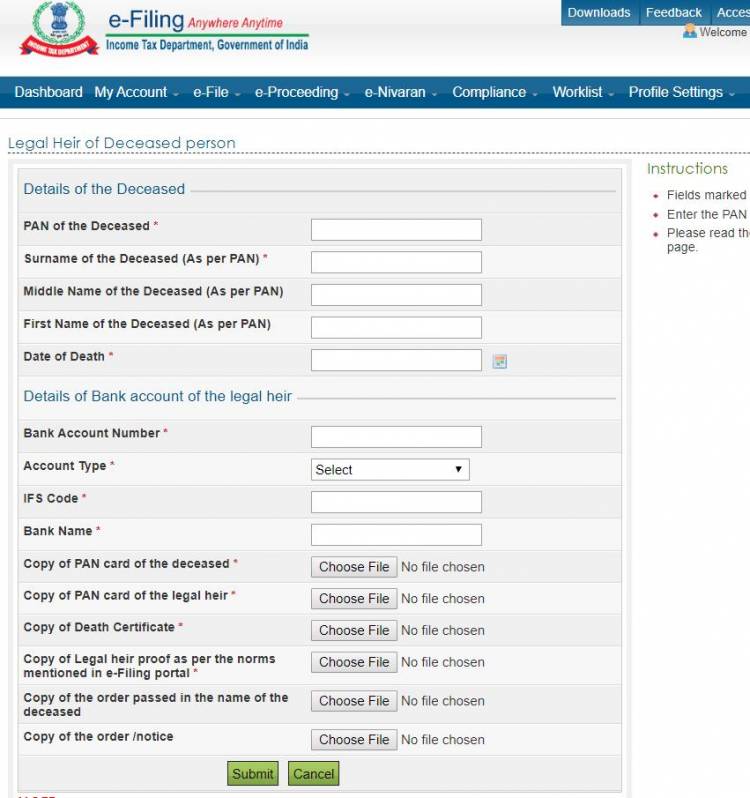

After that below shown window shall open….. fill following details in below window:

- PAN no. of deceased

- Surname, middle name and first name of deceased

- Date of birth of deceased

- Bank account details of legal heir

- Pan no. of legal heir

- Copy of death certificate

- Copy of proof of legal heir

- Copy of order passed in the name of deceased, if any

After filling all the details and attaching all the documents, press submit button. You will get acknowledgement from the department with Transaction ID.

F. Process to file ITR as legal heir:

i) click on www.incometaxindiaefiling.gov.in

ii) login with credentials of legal heir

iii) click on e-file tab and select income tax return

iv) select the PAN of legal heir and select assessment year

v) upload xml file

vi) legal heir can use his DSc for signing purpose

vii) click on submit

ix) Now either e-verify the return or download ITR-V and signed signed copy to CPC, Bangalore.

Download APP

Download APP

P K Gupta

P K Gupta